We make the complex simple.

We offer bookkeeping, payroll, tax preperation and tax planning services, so you can focus on everything else in your business.

LOCAL

PBK Services is your trusted local choice in Fort Worth for precise and efficient tax and bookkeeping services.

EXPERIENCED

PBK Services is a seasoned choice for taxes and bookkeeping, providing a proven track record of reliable financial expertise.

PROFESSIONAL

PBK Services ensures meticulous financial management with a commitment to excellence.

About

Douglas Pratt, the owner and founder of PBK Services, brings over 28 years of extensive experience in finance and banking to the forefront. With a vision centered on aiding small to mid-size businesses in achieving sound financial reporting, he established PBK Services.

As an IRS Enrolled Agent, Mr. Pratt is uniquely distinguished as a federally-authorized tax practitioner, showcasing proven technical competence in tax law. Enrolled Agents are the sole taxpayer representatives licensed to practice by the United States government, highlighting Mr. Pratt’s commitment to providing clients with expert guidance and ensuring compliance in tax matters.

About

Douglas Pratt, the owner and founder of PBK Services, brings over 28 years of extensive experience in finance and banking to the forefront. With a vision centered on aiding small to mid-size businesses in achieving sound financial reporting, he established PBK Services.

As an IRS Enrolled Agent, Mr. Pratt is uniquely distinguished as a federally-authorized tax practitioner, showcasing proven technical competence in tax law. Enrolled Agents are the sole taxpayer representatives licensed to practice by the United States government, highlighting Mr. Pratt’s commitment to providing clients with expert guidance and ensuring compliance in tax matters.

Services

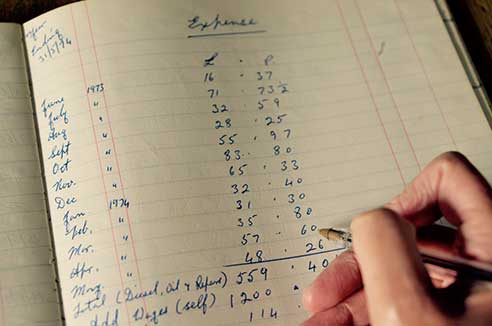

Book Keeping

PBK Services offers comprehensive bookkeeping services, diligently managing and organizing financial transactions for businesses, ensuring precision and compliance in financial record-keeping.

Consulting

PBK Services delivers expert consulting services, offering tailored tax planning and guidance to businesses and individuals, facilitating informed decision-making and sustainable financial growth.

Payroll

PBK Services streamlines payroll processes for businesses in Fort Worth, providing efficient and accurate payroll services to ensure timely employee compensation and compliance with payroll regulations.

Tax Returns

PBK Services specializes in meticulous personal and business tax return services, ensuring that you benefit from accurate filings, navigating complex tax codes to optimize returns and compliance.

Doug has been preparing our taxes and keeping our books for some time now, and we are incredibly pleased with his work. He is always highly responsive and answers all of our questions. He has also been meticulous in keeping our books. Thank you, Doug, for allowing us to focus on growing our business by taking this essential function off our hands!

Doug has been preparing our taxes and keeping our books for some time now, and we are incredibly pleased with his work. He is always highly responsive and answers all of our questions. He has also been meticulous in keeping our books. Thank you, Doug, for allowing us to focus on growing our business by taking this essential function off our hands!

About

Enrolled agents (EAs) are federally authorized tax practitioners who have demonstrated technical competence in tax law and are the only taxpayer representatives licensed to practice by the United States government. Only EAs, attorneys and CPAs may represent taxpayers without limitation before the IRS. EAs advise and represent taxpayers who are being examined by IRS, taxpayers who are unable to pay, and taxpayers who wish to avoid or recover penalties. EAs prepare tax returns for individuals, partnerships, corporations, estates, trusts and any other entities with tax-reporting requirements. Unlike attorneys and CPAs, who may or may not choose to specialize in taxes, all EAs specialize in taxation and are required by the federal government to maintain their professional skills with continuing professional education.